Maintenance Notification:

Blue Access for Members and quoting tools will be unavailable from 3am - 6am on Saturday, October 20.

We apologize for any inconvenience.

Maintenance Notification:

Blue Access for Members and quoting tools will be unavailable from 2am - 5am Saturday, October 20.

We apologize for any inconvenience.

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. Rather than a set copay, you pay a percentage of that drug’s cost. While an inexpensive generic drug may be subject to a minimal copay, a rare brand-name drug may be subject to, for example, a 40% coinsurance. This coinsurance is usually applicable after your deductible is met.

- Member

- Returning Shopper

- Employer

- Producer

» New User? Register Now

Copay Vs Out Of Pocket

» Forgot user name or password?

» Forgot user name or password?

» New User? Register Now

» Forgot user name or password?

» Take a tour.

» New User? Register Now

» Forgot user name or password?

Understanding the Difference Between Coinsurance, Copays and Deductibles

April 29, 2020

Insurance jargon can be confusing.

It can be a struggle trying to understand what coinsurance, copays and deductibles mean, especially what it means to your pocketbook. However, the basic concepts are easy to understand.

Understanding what these terms mean will help you understand your SmartHealth plan and how it works, and it may even help save you money.

Out-of-pocket expenses

Coinsurance, copays and deductibles are all examples of out-of-pocket expenses for a person participating in their company’s medical plan.

Out-of-pocket costs are expenses for your medical care that aren’t paid for by your SmartHealth plan. Even if you are paying for certain costs out-of-pocket, you are still paying a discounted rate for the services if you are receiving care in-network, because you are a SmartHealth member.

Meeting the deductible

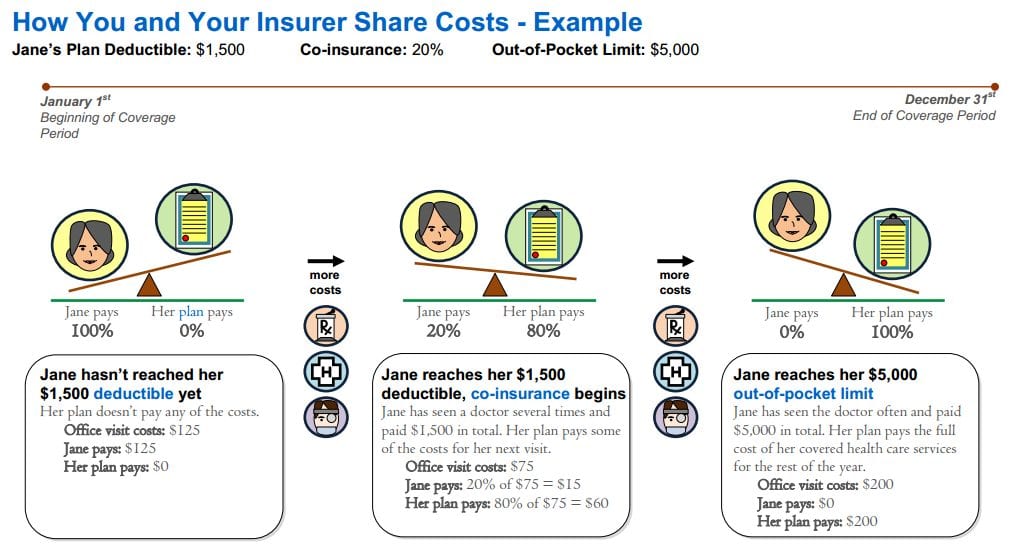

Before a medical plan will begin covering healthcare bills, the plan member needs to pay or “meet” out of their own pocket a certain amount of money.

That is the deductible -- the amount of money a member must pay out of their own pocket before a medical plan will start paying for costs.

That amount of money is described and specified by the documents provided by the plan when a subscriber enrolled in the plan.

Even after a deductible has been met, there may still be costs for medical services member’s receive.

Sharing the cost

As medical coverage costs companies so much, costs need to be shared between the member and the company. A deductible is one form of cost sharing, but even once it is met, healthcare is so expensive that a member needs to continue to help pay the medical bills, through coinsurance and copayments, or copays. The cost to the member for these in-network services is still at a discounted rate.

How Do Deductibles Work With Copays

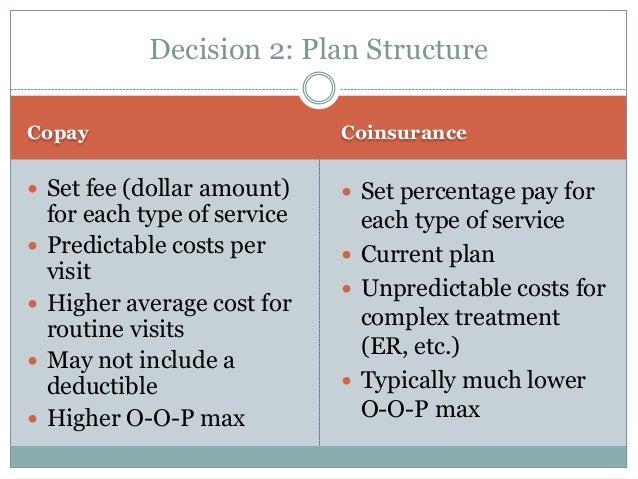

Copays and coinsurance are not usually and not necessarily mutually exclusive, depending on the plan. They are the costs that the plan participant agreed to pay when they signed up for their medical plan and they are the costs laid out by the plan’s documents.

Coinsurance

Coinsurance is the portion or percentage of a shared cost that a subscriber pays after a deductible has been met.

For example, a member might have coinsurance of 20% for particular healthcare services, like a visit to the doctor’s office. If a visit to the doctor’s office costs $100 and the member’s deductible has been met, the subscriber will owe $20, which is the coinsurance.

Copayment

Copayment or a copay is a member’s set cost for some particular services, and sometimes the deductible has to be met before the member only has to pay the copay for the service.For example, a member might have a copayment of $20 for all visits to their Ascension Network doctor’s office. If the subscriber’s deductible has been met, the subscriber will owe $20 for a visit to the doctor’s office, which is the copayment. Generally, different copays or copayment will be charged for different services. For example, you would pay a lower copay to see an Ascension Network (Tier 1) and a higher cost to see a doctor that is in the National Network (Tier 2) or Out-of-Network Tier 3. Additionally, you may only be charged a copay for receiving services from an Ascension Network (Tier 1) provider but you may be required to pay a coinsurance amount, a percentage of the visit cost, for seeing a National Network or Out-of-Network provider.

Copay Coinsurance Deductible Out Of Pocket Example

Understanding the Terms, Using the Terms and Using Your Medical Plan

Understanding the terms coinsurance,copayment and deductible are key to using your medical plan. If you understand what you are paying for and why, it makes it easier to understand how to use your SmartHealth plan and to be an educated healthcare consumer. Now that you know a little bit more about what these terms mean and how they apply, look through your schedule of benefits and look at how these out-of-pocket costs apply to your plan. For all plans, you will notice that you will have the lowest out-of-pocket costs by using the Ascension Network (Tier 1).